The real estate industry in Bangladesh has been experiencing remarkable growth, driven by rapid urbanization, an expanding middle class, and increasing demand for affordable housing.

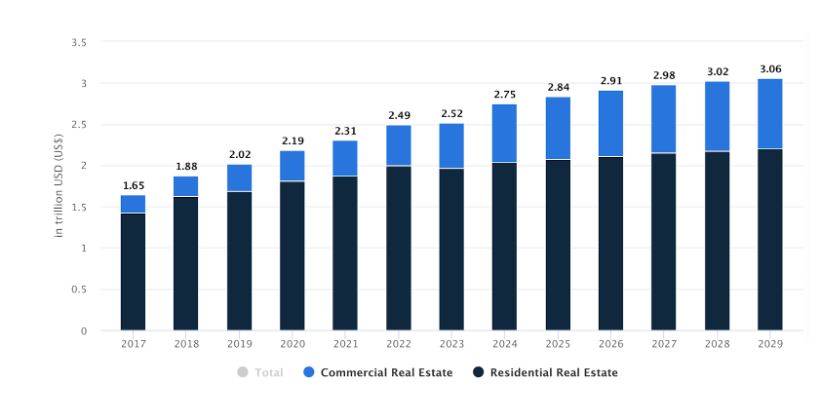

The market is expected to reach a value of US$2.84 trillion by 2025, with the residential real estate segment dominating at US$2.08 trillion.

With a projected annual growth rate of 1.97% from 2025 to 2029, the industry is on track to reach US$3.07 trillion by 2029.

This article explores key trends, growth drivers, and prospects of the real estate sector in Bangladesh.

Current Market Structure

The real estate market in Bangladesh encompasses transactions related to residential and commercial properties, including sales, leases, and development projects.

The residential segment consists of houses and apartment leases, while commercial real estate covers office spaces, retail centers, and industrial properties.

Key performance indicators (KPIs) that define the market include:

- Total real estate value (aggregated across all regions)

- Average real estate value

- Transaction revenue

- Number of properties sold and leased

- Dwelling type shares (percentage of people living in houses vs. apartments)

Emerging Trends in the Real Estate Market (2024 & Beyond)

Several emerging trends are shaping the future of the Bangladeshi real estate market:

The Rise of Vertical Living

With land scarcity in urban centers like Dhaka and Chattogram, high-rise residential buildings are becoming more popular. Developers are focusing on constructing apartments that maximize space efficiency while incorporating modern amenities.

Mixed-Use Developments

Modern buyers are seeking convenience, leading to the growth of mixed-use developments that integrate residential, commercial, and recreational spaces within a single complex.

Sustainable and Smart Housing

There is an increasing demand for eco-friendly housing solutions, smart home technology, and energy-efficient buildings. Real estate developers are adopting green building practices to cater to environmentally conscious buyers.

Affordable Housing Expansion

Driven by urban migration and government initiatives, the demand for low-cost housing is on the rise. Policies supporting affordable housing development are encouraging real estate investments in suburban and peri-urban areas.

Foreign Investment Growth

International investors are showing interest in Bangladesh’s real estate sector, particularly in gated communities, commercial complexes, and infrastructure projects. Foreign capital inflow is modernizing construction methods and urban planning.

Projected Growth and Market Value

Residential Sector Outlook

The residential real estate market is anticipated to reach US$2.08 trillion by 2025, with continued growth fueled by:

- Population growth and urbanization

- Government incentives for housing projects

- Increased accessibility to home financing

- By 2029, the market is projected to expand to US$3.07 trillion, indicating sustained demand for housing and infrastructure.

Commercial Real Estate Growth

The commercial sector, including offices, shopping malls, and industrial properties, is also expected to witness steady growth. The rise of corporate hubs and business parks is attracting local and foreign investments, further strengthening this segment.

Real Estate Market Trends and Customer Preferences in Bangladesh

Customer Preferences

In Bangladesh, there is a growing demand for real estate properties, particularly in urban areas. Customers are increasingly looking for affordable housing options that provide modern amenities and convenient access to essential services such as schools, hospitals, and shopping centers.

Additionally, there is a rising interest in gated communities and high-rise apartment complexes that offer security and a sense of community.

Trends in the Market

One notable trend in the real estate market in Bangladesh is the increasing popularity of vertical living. With limited land availability in urban areas, developers are focusing on constructing high-rise buildings to accommodate the growing population.

This trend is also driven by the desire for modern and luxurious living spaces that offer panoramic views of the cityscape.

Another trend is the emergence of mixed-use developments, which integrate residential, commercial, and recreational spaces in a single complex. These developments cater to the needs of urban dwellers who seek convenience and accessibility to various amenities within proximity.

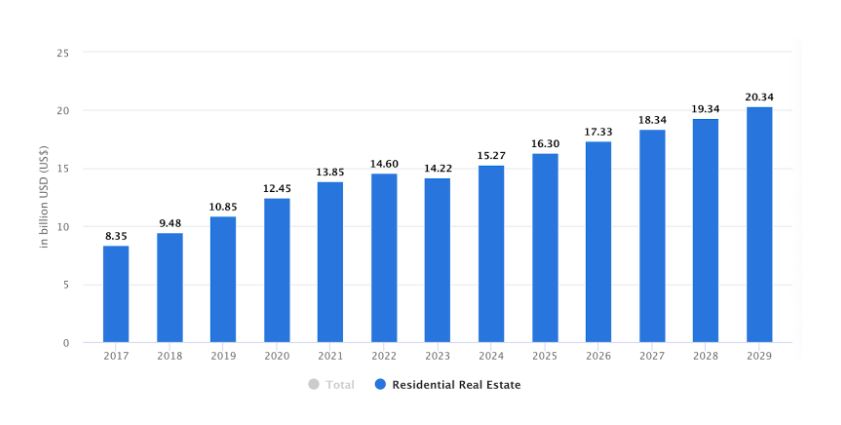

Source: Statista Market Insights

This graphic only shows the residential real estate market. Data were converted from local currencies using the year’s average exchange rates.

Local Special Circumstances

Bangladesh is experiencing rapid urbanization, with a significant portion of the population migrating from rural areas to cities in search of better job opportunities and a higher standard of living.

This influx of people has created a demand for housing and infrastructure development in urban areas, leading to the growth of the real estate market.

Furthermore, government initiatives such as the Vision 2021 and Vision 2041 plans have prioritized the development of the real estate sector as a means to drive economic growth and alleviate poverty.

These plans include the construction of affordable housing projects and the establishment of special economic zones to attract foreign investment.

Underlying Macroeconomic Factors

Source: Statista Market Insights

This graphic exclusively includes residential real estate sales. Data were converted from local currencies using the year’s average exchange rates.

The steady economic growth of Bangladesh, along with low interest rates and favorable government policies, has contributed to the expansion of the real estate market.

The country’s GDP growth rate has been consistently positive, leading to increased disposable income and purchasing power among the population. This, in turn, has fueled the demand for real estate properties.

Additionally, the steady inflow of remittances from overseas Bangladeshis has played a significant role in boosting the real estate market. Many individuals choose to invest their remittances in properties, further driving the demand.

Source: Statista Market Insights

Data were converted from local currencies using the year’s average exchange rates.

Key Drivers of Real Estate Growth in Bangladesh

Urbanization and Population Growth

The urban population in Bangladesh is increasing at an unprecedented rate, with projections indicating that 40% of the population will reside in cities by 2030. This shift is creating high demand for modern housing and commercial spaces, particularly in Dhaka, Chattogram, and Khulna.

Government Initiatives and Policies

The government has launched several programs to boost the real estate sector, including:

Vision 2021 & Vision 2041: Focus on affordable housing and urban planning.

Incentives for developers: Tax benefits and infrastructure support for real estate projects.

Smart City Initiatives: Development of planned urban zones with modern facilities.

Macroeconomic Stability & Investment Growth

GDP Growth: As Bangladesh’s economy expands, higher disposable incomes are fueling property investments.

Low-Interest Rates: Affordable financing options are making homeownership more accessible.

Foreign Direct Investment (FDI): Increased international interest is bringing in capital and expertise.

Remittance Inflow: Overseas Bangladeshis are investing heavily in real estate, particularly in residential projects.

Investment Opportunities in Real Estate

Bangladesh’s real estate market offers lucrative opportunities across various segments:

Residential Properties

Investing in apartments, condominiums, and housing complexes remains a prime option due to consistent demand.

Commercial and Office Spaces

With the rise of corporate culture and start-up ecosystems, office spaces in Dhaka, Chattogram, and Sylhet are witnessing increased demand.

Retail and Mixed-Use Developments

Shopping malls and mixed-use developments continue to grow, offering high rental yields for investors.

Industrial and Logistics Real Estate

As e-commerce expands, the need for warehousing, logistics centers, and manufacturing spaces is increasing.

Conclusion

The real estate market in Bangladesh is experiencing rapid growth due to customer preferences for affordable housing and modern amenities.

Trends such as vertical living and mixed-use developments, local special circumstances of rapid urbanization and government initiatives, and underlying macroeconomic factors such as economic growth and remittances.

These factors combined create a favorable environment for the continued expansion of the real estate market in Bangladesh.

Frequently Asked Questions (FAQs)

What are the legal requirements for buying property in Bangladesh?

Before purchasing a property in Bangladesh, buyers should verify land ownership documents, check mutation records, and ensure that the seller has a clear title. It’s advisable to consult a lawyer to review all legal paperwork and confirm there are no disputes.

Can foreigners buy property in Bangladesh?

Foreigners are generally not allowed to purchase land in Bangladesh. However, they may invest in apartments or commercial properties through joint ventures or special permissions. Consulting a legal expert is crucial for understanding the latest regulations.

What are the financing options available for real estate buyers?

Banks and financial institutions in Bangladesh offer home loans with interest rates varying between 7-10%, depending on the bank and loan tenure. Some developers also provide installment-based payment plans for buyers.

How does the real estate sector contribute to Bangladesh’s economy?

The real estate sector is a major driver of economic growth in Bangladesh, creating jobs in construction, infrastructure, and related industries. It also attracts significant investments, including remittances from overseas Bangladeshis.

What challenges does the real estate market in Bangladesh face?

Despite its growth, the sector faces challenges such as rising land prices, bureaucratic delays in approvals, and concerns over land disputes. Additionally, rapid urbanization has led to congestion and infrastructure strain in major cities like Dhaka and Chittagong.